If you’re planning to apply for the Asaan Karobar Card, it’s crucial to first understand the Asaan Karobar Card Eligibility Criteria. These criteria outline the requirements to ensure that your application is accepted and processed smoothly. By meeting these conditions, you can avoid any delays or rejections. In this guide, we’ll walk you through the key eligibility points and highlight common mistakes to avoid.

For More Information: Honhaar Scholarship Phase 2

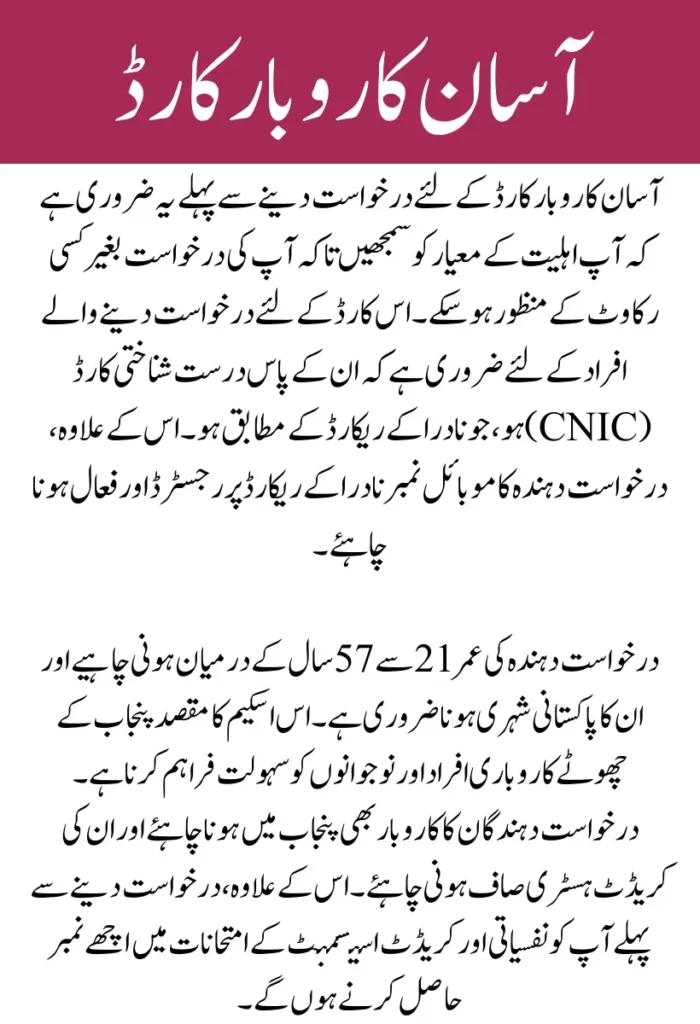

Requirements for Asaan Karobar Card Eligibility

To successfully apply for the Asaan Karobar Card Scheme, you must meet the following eligibility criteria:

- Valid CNIC: Applicants must have a valid CNIC (Computerized National Identity Card) according to NADRA records.

- Registered Mobile Number: The mobile number registered with NADRA under the applicant’s name or CNIC must be valid and in use.

- Age Range: The applicant’s age should fall between 21 and 57 years old at the time of application.

- Pakistani Citizenship: Only Pakistani nationals who are residents of Punjab are eligible to apply for the Asaan Karobar Card.

- Target Audience: This scheme is specifically for small entrepreneurs, especially young entrepreneurs, within the Punjab province.

- Business Location: Whether you currently own a business or plan to start one, the business must be based in Punjab.

- Clear Credit History: Applicants must have a clean credit record with no outstanding or overdue loans.

- Psychometric and Credit Assessment: A satisfactory score on both the psychometric test and the credit assessment is required for eligibility.

- One Application Per Person and Business: Only one application is allowed per individual and business entity, ensuring fairness across all applicants.

Conditions You Must Know About the Asaan Karobar Card

Before applying for the Asaan Karobar Card, it’s important to be aware of these conditions:

- Business-Only Fund Usage: The funds from the Asaan Karobar Card must be used exclusively for business purposes. Non-business-related transactions will be blocked.

- Tax Registration: Applicants must register with the Punjab Revenue Authority or the Federal Board of Revenue within six months of receiving the card.

- One Application Rule: As previously mentioned, only one application is permitted per individual or business. Confirm you meet all eligibility requirements before submitting.

For More Information: Punjab Rashan Card Eligibility Criteria

Common Mistakes to Avoid When Applying

While applying for the Asaan Karobar Card, there are some common mistakes that many applicants make. By understanding these pitfalls, you can ensure a smooth and successful application process:

1. Incomplete or Incorrect Documentation

This is one of the most frequent mistakes. Ensure all required documents are submitted correctly and in full to avoid delays or rejection of your application.

2. Overlooking the Asaan Karobar Card Eligibility Criteria

Not fulfilling the Asaan Karobar Card Eligibility Criteria can result in the rejection of your application. Double-check that you meet all the conditions before proceeding.

3. Lack of a Solid Business Plan

A clear and detailed business plan is essential for your application. If you don’t have one, it could lead to rejection. Make sure to outline how you plan to use the funds and how you intend to repay them.

4. Failure to Understand Loan Terms

It’s important to fully understand the loan terms before applying. Misunderstanding these terms can lead to complications later on, so take the time to read and comprehend the full agreement.

Need Help? Contact the Helpline

If you have any queries or need further clarification on the Asaan Karobar Card Eligibility Criteria, you can still contact the dedicated helpline. They can assist you with any concerns regarding the application process.

Final Thoughts on Asaan Karobar Card Eligibility Criteria

Understanding the Asaan Karobar Card Eligibility Criteria is important for a successful application. Ensure you meet all the requirements before applying to avoid any unnecessary delays or rejections. By following the guidelines and avoiding common mistakes, you can streamline the application process and increase your chances of approval.

If you have any doubts or need help, don’t hesitate to reach out to the helpline to get your queries answered.

Frequently Asked Questions

Can I apply if I don’t have an existing business?

Yes, you can apply as long as you plan to establish a business in Punjab.

Am I eligible if I am not a citizen of Punjab?

No, the Asaan Karobar Card is only available to residents of Punjab as it is a provincial initiative aimed at supporting local entrepreneurs.