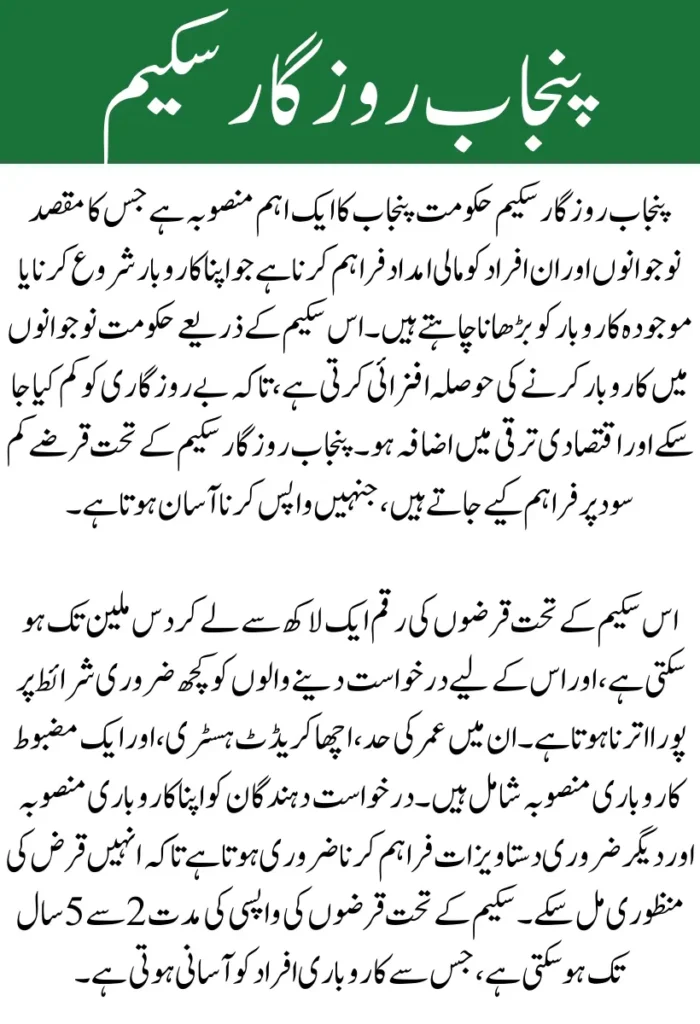

The Punjab Rozgar Scheme is a major initiative by the Government of Punjab aimed at providing financial support to youth and individuals looking to start or expand their businesses. Through this scheme, the government hopes to promote entrepreneurship, create jobs, and reduce unemployment in the province. This initiative not only provides financial aid but also fosters a spirit of self-reliance among the people of Punjab.

For More Information: Punjab Bewa Sahara Card Online Registration

What is the Punjab Rozgar Scheme?

Launched to assist the youth and small entrepreneurs, the Punjab Rozgar Scheme offers financial loans to individuals who wish to establish or expand their businesses. The loans provided under the scheme are designed to be affordable, with low-interest rates, making it easier for applicants to manage their repayments. The goal is to enable applicants to become self-sufficient and contribute to the economic development of Punjab.

Features of the Punjab Rozgar Scheme

The Punjab Rozgar Scheme offers several benefits to eligible applicants. Some key features include:

- Loan Amount: The loans range from PKR 100,000 to PKR 10 million, depending on the applicant’s business plan and needs.

- Interest Rate: A subsidized interest rate of 4% to 5% per annum is applied to loans, making it affordable for young entrepreneurs to repay.

- Repayment Terms: Loan repayment terms range from 2 to 5 years, ensuring flexibility for business owners.

These features make the Punjab Rozgar Scheme a highly attractive opportunity for aspiring business owners.

Eligibility for the Punjab Rozgar Scheme

To apply for the Punjab Rozgar Scheme, applicants must meet certain criteria. The eligibility requirements are as follows:

- Age Requirement: Applicants must be between 20 and 50 years old.

- Residency: The applicant must be a resident of Punjab, Pakistan.

- Business Plan: A solid business plan that outlines how the loan will be used, the business structure, and the potential for success is required.

- Credit History: Applicants must have a good credit history with no record of loan defaults.

For More Information: Punjab Honhaar Scholarship Phase 2 Apply Online & Last Date Details

Documentation Required for Application

To apply for the Punjab Rozgar Scheme, applicants must submit the following documents:

- A valid CNIC (Computerized National Identity Card).

- A recent passport-sized photograph.

- Proof of educational qualifications.

- A business plan for new or existing businesses.

- Any business registration certificates or legal documents if applicable.

Step-by-Step Guide to Apply Online

The application process for the Punjab Rozgar Scheme is relatively simple and can be completed online. Here’s a step-by-step guide:

- Step 1: Visit the official Punjab Rozgar Scheme portal.

- Step 2: Create an account by providing your details, including your name, CNIC number, and contact information.

- Step 3: Fill out the online application form and provide the necessary details about your business.

- Step 4: Upload the required documents, such as your CNIC, photographs, and business plan.

- Step 5: Pay the processing fee through the available online payment methods.

- Step 6: Apply and wait for approval.

Once the application is submitted, it will be reviewed, and you will be notified of the outcome.

Last Date for Online Application

It’s important to keep track of the last date for online application to avoid missing out on this opportunity. The application window for the Punjab Rozgar Scheme may open and close periodically. Applicants should regularly check the official website or any announcements from the Punjab Small Industries Corporation (PSIC) to stay updated on the last date for submission. Failing to apply by the last date could result in missed opportunities for obtaining a loan.

For More Information: Asaan Karobar Card Errors, Eligibility, and Helpline Number Details

Benefits of Applying for the Punjab Rozgar Scheme

The Punjab Rozgar Scheme offers numerous benefits to eligible applicants:

- Financial Support: Low-interest loans help entrepreneurs with limited capital to start or expand their businesses.

- Job Creation: By assisting entrepreneurs, the scheme encourages job creation, contributing to a reduction in unemployment.

- Economic Growth: The initiative helps promote economic activity and development in Punjab by supporting local businesses.

- Flexible Terms: The scheme offers flexible loan repayment options, making it easier for entrepreneurs to repay without financial strain.

Common Challenges and How to Overcome Them

While the scheme offers a great opportunity, there are a few challenges applicants may face:

- Complex Business Plan Creation: Many first-time entrepreneurs may struggle to create a comprehensive business plan. Seeking assistance from business mentors or consultants can help ensure a more professional submission.

- Document Preparation: Collecting all the required documents can be time-consuming. Applicants should ensure they gather all necessary paperwork in advance.

- Understanding Loan Terms: Some applicants may find the loan terms unclear. It is advised to carefully read the terms or reach out to the PSIC for clarification.

Conclusion

The Punjab Rozgar Scheme is an excellent opportunity for individuals in Punjab who are eager to start their businesses or expand existing ones. By offering low-interest loans with flexible repayment terms, this initiative helps empower entrepreneurs and contributes to the overall economic growth of the region.

Remember to stay informed about the application deadlines and submit your application on time to take full advantage of this opportunity. If you meet the eligibility criteria and have a solid business plan, the Punjab Rozgar Scheme could be your stepping stone to success.